monsitj/iStock via Getty Images

With Upstart (UPST) down 70% from its all-time highs, I believe that this could be an excellent buying opportunity for investors looking for a high growth fintech company with strong moat.

Investment thesis

There’s lots that I am positive on with regards to Upstart, and here are the key investment highlights for the company:

- Upstart’s superior Artificial Intelligence (AI) model brings real benefits to both consumers and its banking partners, and this AI competitive advantage will only improve and widen with time.

- Capital light model as an intermediary between consumers and its banking partners.

- Upstart is expanding its total addressable market (TAM) into the huge auto loan origination market, demonstrating a large market opportunity.

- Upstart’s margins and unit economics have seen improvements and will likely continue in that trend as a result of increased automation and scale.

Overview

Upstart is a leading AI, cloud based lending platform. With its platform, Upstart aggregates consumer demand for loans and connects it to its network of bank partners.

In my opinion, Upstart’s two way value proposition with its consumer and bank partners is a valuable asset for the fintech company.

The value proposition of Upstart-powered loans to consumers are that it provides consumers with lower interest rates, higher approval rates and a highly automated and digital experience.

The value proposition of Upstart-powered loans to its bank partners are ease of new customer acquisition, lower loss and fraud rates, and increased automation in the entire lending process.

Industry

Value proposition is using AI and alternative data to provide best-in-class underwriting accuracy for its banking partners, resulting in higher loan approvals for the same risk loss, lower APR for consumers and a highly automated efficient all digital experience.

The lending industry is in need of a disruptor to change processes and make things more efficient. Most traditional financial institutions still use the same FICO scores that were used more than 20 years ago to make decisions on loans today. The slow adoption of new practices and new standards by the big banks and lenders are what creates new opportunities for smaller tech enabled companies. Furthermore, some 48% of lenders have less confidence in making loan decisions based on the traditional credit scores. This means that a new model for measuring risk and for helping financial institutions decide who to lend to and rates at which to lend to.

Upstart is one of the most successful so far in the industry in using AI and machine learning to train models over tens of thousands of training data points and result in an AI model that is superior to the industry standards and provide a true value add to consumers and bank partners.

This unique competitive advantage will create a flywheel effect as more and more banks are interested in powering their loans via Upstart to improve their processes and reduce risks. With more banks rolling out Upstart products, more consumers also purchase Upstart-powered loans that have better approval rates and lower interest rates. With more consumers and more loans provided, Upstart’s AI models and machine learning capabilities only grow stronger and hence its competitive moat becomes more resilient over time.

Novel AI technology

I believe that the core thesis behind my investment call on Upstart lies in its AI technology that enables it to be superior to peers from both the eyes of the consumers and its bank partners, making it the top choice for both.

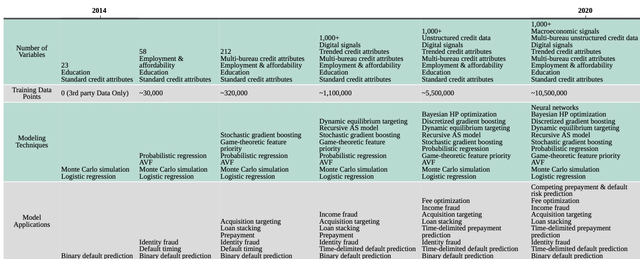

As can be seen from the diagram below, Upstart’s AI model started off with 23 variables in 2014 and grew to more than 1000 variables in 2020. Of significance, in 2014, Upstart only had 3rd party data as training data points but today, it has 10.5 million training data points, further fine-tuning the AI model for perfection. Over the years, Upstart also expanded to use more sophisticated modelling techniques and applications. Today, the AI model generates a reliable, accurate, and superior result based on the many layers of barriers to entry that it has spent the past 6 years perfecting.

Training of AI model since 2014 Upstart 2020 AR

Despite the high level of complexity of Upstart’s models, it delivers all of these to its bank partners through a simple cloud application which can be tailored to the varying lending needs of its bank partners to meet their different business needs. Some of the ways bank partners can customise includes loan duration, minimum credit score, etc. Upstart’s platform enables the origination of loans that are compliant to the relevant regulations all at a low cost per loan.

A superior AI model will result in superior results for Upstart. The CFPB claimed that its study of Upstart’s data found that its AI model approves 27% more borrowers than other traditional lending models, while the average APR for approved loans is 16% lower. This translates to significant opportunity for Upstart for both consumer and bank partners due to the strong value proposition it provides. Of note, it opens up a unique opportunity for Upstart as consumers with FICO scores from 620 to 660 that are considered “near prime” are approved almost twice more than in traditional models. Also, consumers who are less than 25 years old are 32% more likely to be approved. According to Upstart, their own analysis suggests that over time, their loan offering have “improved significantly over time” compared to competitors.

With improvements in Upstart’s AI models over time and the application of these models to different stages of the loan process, Upstart has managed to automate an increasing portion of the loan process and provide consumers with a digital experience like no other. Consumers that apply for a loan through Upstart’s website or directly through a bank partner’s website will have a loan application process that is streamlined into a single application process and the loan offers provided are firm. With increased automation, as of Dec 2020, almost 70% of Upstart-powered loans were immediately approved without needing any uploading of any document or phone call, up from 0% in 2016.

There are also distinct benefits that the superior AI model bring to Upstart’s bank partners. First, Upstart claims that its study found that its AI model could lower loss rates by 75% while maintaining approval rates, when compared to the replicated bank models of 3 large banks. Second, the AI enabled digital experience enables regional banks and credit unions to have a cost effective way to compete with larger competitors.

Capital-light model

Serving as an intermediary for the consumer and its banking partners, Upstart utilises a capital-light model for expansion. In fact, Upstart retains only 2% of its loans on its balance sheet, mainly for research and development purposes.

The loans issued through the Upstart platform can either be retained by its bank partners, distributed to a large group of about 100 third party investors like Goldman Sachs, Morgan Stanley, Pimco, etc. The portion of loans sold to third party investors makes up 76% of the loans funded through Upstart’s platform, while its banking partners retained the remaining 22%.

“Loans issued through our platform can be retained by our originating bank partners, distributed to our broad base of institutional investors and buyers that invest in Upstart-powered loans or funded by Upstart’s balance sheet. In the year ended December 31, 2020, 21% of the loans funded through our platform were retained by the originating bank and 77% of loans were purchased by institutional investors through our loan funding programs. Our institutional investors and buyers that participate in our loan funding programs invest in Upstart-powered loans through whole loan purchases, purchases of pass-through certificates and investments in asset-backed securitizations. A large fraction of the whole loans sold to institutional investors under our loan funding programs are originated by Cross River Bank, or CRB. In the year ended December 31, 2020, CRB originated 67% of the loans facilitated on our platform and fees received from CRB accounted for 63% of our total revenue. Our current agreement with CRB began on January 1, 2019 and has an initial four year term, with a renewal term for an additional two years following the initial four year term. We enter into nonexclusive agreements with our whole loan purchasers and each of the grantor trust entities in our asset-backed securitizations, pursuant to which we provide loan servicing.”

Huge future market opportunity

Although Upstart’s unsecured personal loans market is one of the fastest growing segments of the credit market in the US, it is only a fraction of the huge US credit market. In my view, with Upstart’s huge success in disrupting the unsecured personal loans market, the natural path would be to continue to apply its AI models and technology to the other credit verticals to serve consumers’ needs. Thus, there is significant potential for Upstart to be successful in auto loans, credit cards, student loans, mortgages, etc. In fact, Upstart began offering auto loans on its platform in 2020 and I believe that with increasing pace of adoption and as the AI model builds a strong foundation, we will start to see an AI model that is superior for auto loans as well.

Improving unit economics

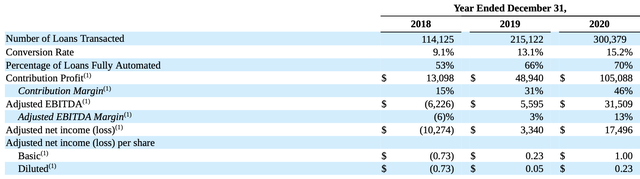

I believe that there are 2 drivers to Upstart’s improving unit economics, and they are scale and automation. The number of loans transacted from 2018 to 2020 almost tripled from 114,125 in 2018 to 300,379 in 2020, while the percentage of loans that are fully automated increased from 53% to 70% from 2018 to 2020.

As a result, contribution margin increased from 15% in 2018, to 31% in 2019 and finally 46% in 2020. Along with it, EBITDA margin increased from -6% in 2018 to 3% in 2019 and 13% in 2020. (Note that Upstart’s contribution margin removes loan acquisition, verification and servicing costs from platform fees.)

Key operating and financial metrics of Upstart Upstart Annual Report

I believe that with continued focus on automation and increasing scale from increasing consumer demand, we will see contribution margin move towards Upstart’s long term target of around 50% to 55%. In fact, the fully automated loans represented almost 70% of loans newly processed. The remaining portion of loans not yet automated are typically for those borrowers with limited credit history and thus require a more manual review process.

For its EBITDA margin, it has a long term target of around 20% to 25% EBITDA margin target, which should be achievable through the improvements in contribution margin as well as improvements and control in SG&A spend.

Peer analysis

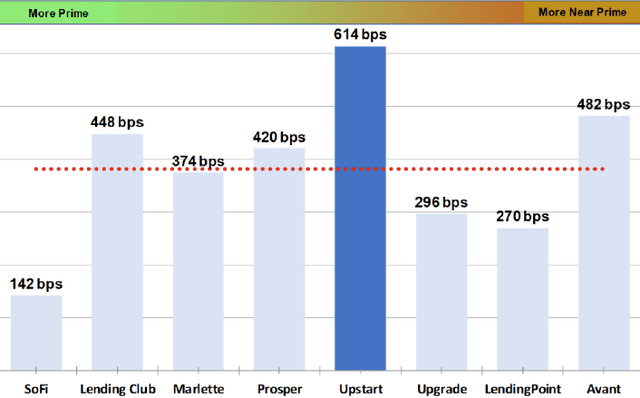

When looking at Upstart’s loans relative to other leading online lending platforms, Citi Research team has done an analysis on data points from several Kroll Securitisation Trust Surveillance Reports that were issued in the past 9 months which I believe is useful in analysing Upstart’s advantage over peers.

It was found that Upstart’s securitisation continues to outperform the rating agency’s base case of cumulative net losses of the company’s loans by 614 basis points, more than 230 basis points better than the average of the sample size of 65 securitisations analysed. This, in my view, suggests underestimation of Upstart’s AI models’ ability to measure and take risks.

Outperformance of Upstart’s loans compared to other leading online platforms Citi research

Valuation

Assuming a 28% market share of the personal loan market, and assuming that Upstart is able to increase auto loans ramp up to 470,000 vehicles by 2025. With an assumption that Upstart is able to achieve its long term contribution margin of 50% and 20% EBITDA margin, I derived a target price of $238.

Other assumptions for my model include a terminal growth rate of 2% and WACC of 7.5%. I think that based on my target price, the higher valuation multiple is warranted given that Upstart is a pure play company with a lending platform based on a proven AI model with a large expansion opportunity into different credit products.

With the target price of $238, this implies an upside potential of 97%. That said, there are elevated risks to Upstart as highlighted below.

Risks

Concentration on unsecured personal loans

Although I mentioned earlier that Upstart has started venturing into auto loans and are looking into options into new products down the road, the majority of its revenues today come from its bread and butter unsecured personal loans segment. This, in my view, is a concentration risk from a business point of view. The roll out and execution of its expansion into new products and new loan categories could be positive to the share price but any slowing of deployment into these new categories and segments could be negative to share price.

Fluctuations in economic conditions

As with all credit issuers and players in the industry, Upstart’s business model and its growth of loan volumes are both very vulnerable to drastic changes in the economy or to financial shocks. This could prove to be particularly painful for Upstart due to its inexperience in handling a downturn. Also, I believe that the risk might be further amplified for Upstart since their AI models have yet to be very extensively tested during a serious financial downturn. Although Upstart does not take balance sheet risks, this could very severely impact the platform and AI model’s credibility.

Competition

Although Upstart has an advantage in its extensive use of AI and machine learning, it could be detrimental to Upstart if its competitors are able to build an AI model more superior to that of Upstart. Thus, it is crucial for Upstart to continue to invest in R&D and continuously improve its AI models and machine learning capabilities to ensure a stronger competitive advantage and to have strong barriers of entry for competitors to establish a similar product.

Conclusion

All in all, I believe that Upstart is revolutionising the lending scene with its novel AI and machine learning technologies that are providing a concrete value add to both consumers and its banking partners. This provides a positive feedback loop and thus a strong flywheel effect where more banking partners and large banks adopt Upstart’s AI models and even more momentum grows for the Upstart-powered loans. With its superior AI models that provide strong competitive advantage, its expanding TAM opportunity from unsecured personal loans to other segments like auto loans and student loans, to its very nimble capital light business model and improving unit economics, I believe that Upstart is a Buy at the current levels after its huge drawdown over the past months, and have a target price of $238, implying a potential upside of 97%.

Credit: Source link