anyaberkut/iStock via Getty Images

Upstart (NASDAQ:UPST) recently reported an excellent 4Q21 results, which showed strong momentum in its business, further expansion into new areas, stellar execution of strategy by the management team. There are several material positive updates for Upstart in their 4Q21 results and I think that it is important to highlight these to investors of Upstart. I reiterate my target price of $238, implying 55% upside to current levels.

Investment thesis

I have done an earlier article on Upstart when I initiated the company which can be found here. This is a summary of the investment thesis of Upstart and these points still hold today and there are additional evidence of the investment thesis playing out, as illustrated in subsequent sections:

- Upstart’s superior Artificial Intelligence (AI) model brings real benefits to both consumers and its banking partners, and this AI competitive advantage will only improve and widen with time.

- Capital light model as an intermediary between consumers and its banking partners.

- Upstart is expanding its total addressable market (TAM) into the huge auto loan origination market, demonstrating a large market opportunity.

- Upstart’s margins and unit economics have seen improvements and will likely continue in that trend as a result of increased automation and scale.

Emergence as a category leader in AI lending

As of 4Q21, Upstart has 42 bank partners compared to the 31 bank partners it had in 3Q21. Furthermore, it has 7 lenders with no minimum FICO score required and thus relies fully on Upstart’s AI models. This was also the first quarter that Upstart managed to achieve more than $4 billion in loan transactions on its platform. This is up from $3 billion in loan transactions in 3Q21, and $1 billion in loan transactions in 4Q20 a year ago. In my view, the ability to grow loan volumes by almost 30% quarter on quarter and grow loan volumes to 4 times that of the prior year demonstrates the fast growth in Upstart’s platform and the strong value proposition it brings to customers.

Furthermore, Upstart currently is a profitable high growth company, with $59 million in net income in 4Q21, up 102% quarter on quarter. With the profitability it is experiencing in its successful unsecured personal lending segment, it is able to invest significantly into the future by doubling headcount in product engineering and machine learning in 2021.

In addition, in my opinion, the ability of Upstart to grow fast and with profitability speaks volumes about the competitive advantage and operating leverage that Upstart has in an industry that is highly competitive. As such, I think that Upstart is poised to become a category leader in AI lending as it provides a huge value proposition both to its bank partners and to customers.

Strong execution in expansion of TAM

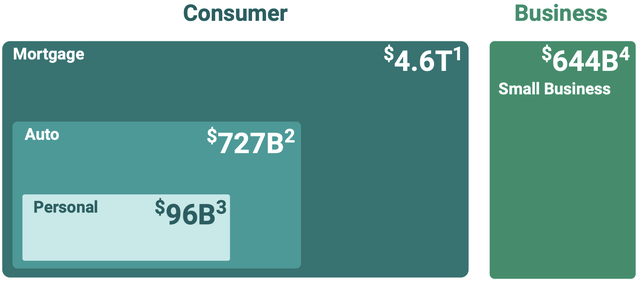

Management shared that after doing most of the ground work for auto loans business in 2021, they are now increasingly confident in Upstart’s ability to excel in the auto loans business. As shown below, Upstart is currently in the personal lending space which has a TAM of $96 billion. It is moving more aggressively into auto loans in 2022, which has a TAM of 727 billion, almost 7x more than personal unsecured lending. Upstart CEO Dave Girouard has repeatedly mentioned in the earnings call that his goal is for Upstart to be a multi-product distributed company and said he hopes to be in the small business market and mortgage market by 2022 and 2023 respectively.

Upstart TAM 2022 (Upstart 4Q21 presentation)

In my opinion, I think this is really positive for the company to have such ambitious growth plans, and at the same time, under the direction of its founder and CEO, Dave Girouard.

On the auto loans front, Upstart’s management is upbeat about gaining traction as it has already given a guidance of $1.5 billion in auto loan financing volumes in FY2022. Furthermore, great progress has been made by the team as they managed to triple dealership footprint and auto refi funnel is now similar to that of 2019 levels for unsecured personal lending. Lastly, 10 bank partners signed up for auto lending on Upstart’s platform.

With the traction that they are seeing in auto loans, management now has the confidence to unleash the AI model and technology improvements to auto loans that will make it as successful as personal lending in the future.

Furthermore, in my view, after being successful in personal lending and also gaining traction into auto loan, management now has the playbook to expand into different markets and build on its TAM expansion with similar strategies with unique tweaks for different segments.

Reinvesting into new businesses

With Upstart’s progress into auto loans in 2021, most of it was funded entirely from its own balance sheet. This is currently the incubation period of its auto loans journey where it is making sure that its AI models work as well as in the unsecured personal lending segment. Once it gains confidence that the AI models are doing its thing and predicting risks well, and when there is sufficient scale in auto loans, this can then be transferred over to institutional investors and bank partners, as per the business model in unsecured personal lending.

As a result, it is important to note that auto loans are right now still at a rather sub-optimal scale compared to that of unsecured personal lending and this might reduce margins in the year ahead. However, this should improve in 2023 as auto loans move towards a fee model similar to that of the unsecured personal lending business in the next quarter and gains in scale similar to that or even larger than its current personal lending business.

This explains the fall in contribution margin from 50% in 2021, to 46% in 1Q22 and 45% for full year 2022.

Furthermore, Upstart is continuing to invest in growing its technical workforce, which has doubled in the last year. In my opinion, I think that this is one of the best investments Upstart can make as the success of its business depends on the AI model, which in turn depends on it hiring the best computer scientists, data scientists, machine learning engineers, product manager out there. I think that Upstart has its right focus on people, which will go a long way for the business.

Clearing misunderstandings about delinquencies

There was an article in a forum and by Wedbush analyst about Upstart seeing a rise in delinquencies, although there was not much information nor context on it. This resulted in some uncertainties about the accuracy of the Upstart model as it started to move into different segments of unsecured lending, ranging from prime to sub-prime customers.

CFO Anjay explained that this was due to a change in its borrowing mix as it expands its lending universe. It was under this context that there is a rise in absolute numbers of default rates, although these have been correctly predicted and priced in Upstart’s models. This is a unique feature of Upstart in that the AI model’s job is to price risk as accurately as possible and when this risk is priced correctly, even if we see rising delinquencies, these have been priced into the loan and not a problem with the model.

Viewed in this context, rising absolute default rates that are correctly predicted and priced are not a bug, but in fact, a feature of our platform and a trend we expect to see continue as we successfully progress against our core corporate mission. As such, as long as the company is predicting correctly and pricing the loans accordingly, this is a good thing for Upstart.

As such, there is no meaningful adverse effect for Upstart from these rising defaults on its loan volume or unit economics.

Initiation of stock repurchase program

Upstart announced a share repurchase program of $400 million during its 4Q21 call. This decision may surprise many investors as I was when I was listening in to the earnings call. This is because Upstart is still a relatively young company and in a high growth mode, which implies that there should be many opportunities for Upstart to reinvest in itself and also to consider acquisitions.

However, CFO Sanjay was quick to explain in the earnings call, the thought process that goes into the share repurchase program. It is actually not a capital allocation decision, given that Upstart management still sees many growth opportunities to invest in the future. The main rationale for the share repurchase program was really to be able to repurchase Upstart’s shares when they are deemed undervalued by management. This decision was supported by the volatility in equity markets we have seen in the year to date and also, Upstart is in the unique position of profitability and thus has the ability to take advantage of this to benefit shareholders.

In my view, I think that management is taking the right step in initiating a share repurchase program as it is maximizing the benefits of its profitability to take advantage of the volatility in the market and especially for Upstart in the recent months. Management can better signal to the market when it deems its stock to be undervalued and can then reverse sentiment and benefit shareholders.

Conclusion

I am gaining more conviction in Upstart as it continues to show its value proposition to consumers and bank partners is very strong, highlighting its unique competitive advantage in a competitive industry. With this, Upstart is able to execute well into new markets and new TAMs and emerge as the category leader for AI lending across different product lines. Furthermore, Upstart’s continued investment into its business and its focus to grow scale, revenue and profits makes it a very investable business. I stand by my target price of $238, implying 55% upside to current levels.

Credit: Source link