imaginima/iStock via Getty Images

Investment Thesis

Wise plc (formerly Transferwise) (LSE: WISE, ADRs: WIZEY, OTC: OTCPK:WPLCF) is a company that I have used privately for years and I am very pleased with it from a user’s point of view. I think the business model still has a lot of room for growth and is just starting. The growth is constant, but the valuation is too high for my taste. But the share is in a downward trend, which means that with a little more patience it will hopefully be buyable at a better price. The numbers in this article are British Pounds unless otherwise stated.

Company introduction

Wise plc is a fintech company that allows users to transfer money between countries without having a traditional bank account. They also offer multi-currency accounts for travelers or entrepreneurs. The company was founded in 2011 by Taavet Hinrikus and Kristo Käärmann, two Estonians who were frustrated by the high fees and slow transfer times of traditional banks. Wise allows users to send money to more than 50 countries. The company has raised more than $200 million in funding, which makes it one of the top-funded startups in Europe. Some famous investors include Richard Branson, PayPal co-founder Max Levchin, and Peter Thiel’s Valar Ventures. The IPO was on July 7, 2021, on the London stock exchange.

How do they make money?

The business model of wise is very simple. They offer customers to send money very quickly all over the world, using the fair real exchange rate. For this service, they take a small fee. Overall, this process is much faster and cheaper for customers than other classic options through banks. Wise even has the goal of lowering the fees even further over time. This is of course ambivalent for investors. On the one hand, it puts pressure on future revenue growth, but on the other hand, it strengthens customer loyalty and satisfaction.

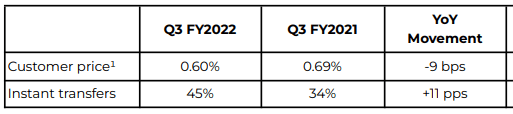

Take rate (Wise Q3 FY2022 Trading Update)

Q3 FY2022 is their last quarter (published January 19, 2022; so refers to the end of 2021). As you can see, since Q3 2021, the fees for customers have been reduced by more than 10%. These are the averages, which means individual currencies may be cheaper or more expensive. The instant transfer rate was also increased significantly. In their latest annual report from June 2021, Wise stated that more than 80% of money transfers arrive within 24 hours and this figure has been improving for years.

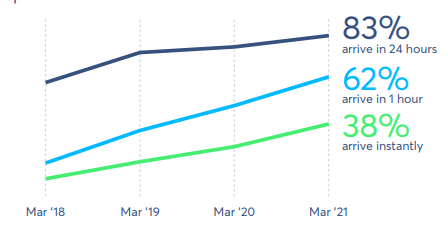

Wise transfer speed (Annual report)

As a customer of banks, I have never understood why transfers sometimes took days and that was also problematic in many situations, such as tight deadlines. Immediate arrival or within an hour is much more convenient for customers.

Private and business accounts

I’m delighted that for the first time we’ve supported more than 4 million customers to complete cross-border transfers in a single quarter. We moved over £20bn; 38% growth on last year and 15% growth on the prior quarter.

Q3 FY2022 Trading Update

They also offer business accounts for entrepreneurs and small/medium businesses. This was introduced only about 3 years ago and has 250,000 customers so far. However, the amounts transferred are significantly higher for business accounts (£21.6k versus £3.7k for personal accounts). Nevertheless, from these figures, it seems that these are currently rather small entrepreneurs and rather no mid-sized companies, otherwise the averages would have to be even higher than £21.6k. Ultimately, Wise is interesting for anyone who deals with different currencies. I’m thinking, for example, of many freelancers who offer their services on Fiverr (FVRR) or similar platforms. They often receive money in USD and have significant costs when they want to convert the money into their home currency via a local bank.

Through Wise, they have either the possibility to exchange the money very cheaply, or not at all if they can use the Wise Debit Card in their country. It does not matter in which currency the money is in the account, when paying it will be converted in real-time into the local currency at the current rate.

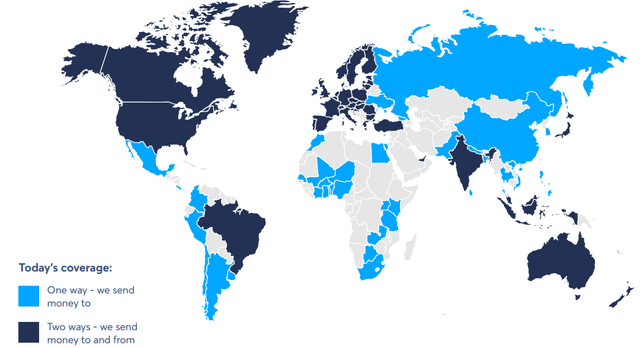

Wise availability (Annual report)

I have a friend who employs several freelancers in the Philippines. He can now pay his employees directly in Philippine Peso, which is very convenient and transparent for his employees. He told me that this method is much cheaper for him than using PayPal (PYPL).

I used to work in Switzerland but ultimately needed my money in Euros rather than Swiss Francs. Nevertheless, my employer was able to pay me normally in CHF, as if I had a local account. This was very easy and convenient for both of us.

Opportunities for further growth

Overall, both the private and business sectors still have enormous potential for the company. Most people I know don’t even know about these new fintech opportunities yet. When they travel abroad, they use much more cumbersome and expensive options. With time this will change more and more because especially traveling people talk and help each other.

Furthermore, the number of freelancers is increasing worldwide. The outsourcing of work to cheaper but skilled workers in India and other countries is still relatively new. As YouTube channels, Instagram influencers, bloggers increase, so will the outsourcing of video editing, WordPress optimization and coding, Website SEO, and so on. These are often long-term relationships and a fast and cheap payment system is needed.

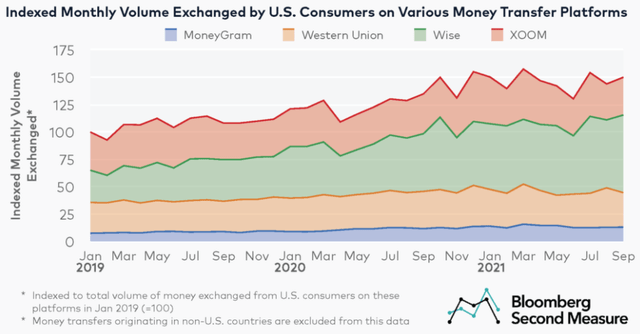

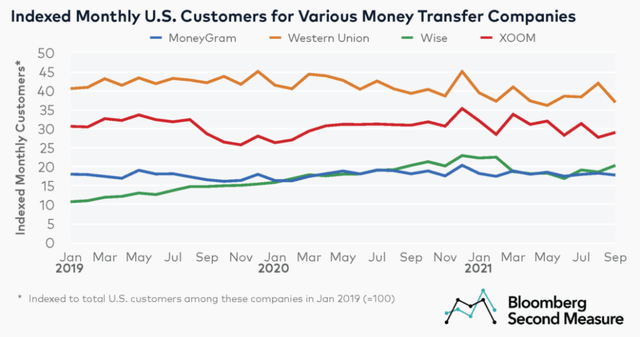

Wise market share (secondmeasure.com)

Wise customers compared to peer group (secondmeasure.com)

Here we see how Wise is gaining more and more market share and old and very expensive players like Western Union are losing. These numbers are also made possible by an increasing number of partnerships. Wise allows their partners to profit from their infrastructure. Examples are N26, Bunq, Monzo, invoice platforms Bilingo and Libeo. The total number is more than 30.

Revenue and valuation

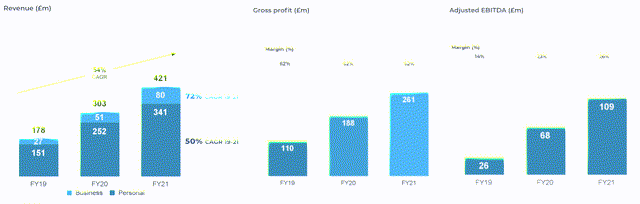

Wise revenue (wise.com)

Sales have been growing at 54% CAGR since FY19 which is very impressive. In the last quarterly report Q3 FY2022 revenue was £149.8M, so should be £550M to £600M for FY2022. The diluted EPS in the first half of FY2022 was 1.23GBp. The same EPS in the second half of FY2022 would result in a total of 2.46GBp, which at the current share price of 585.40GBp would result in a P/E ratio of 237.

Unfortunately, it is surprisingly difficult to specify an EV/S because the enterprise value is not that easy to find out. The market capitalization is currently 8.333B. According to Yahoo Finance, the debt is about 0.1B. But it gets tricky with the cash position. Seeking Alpha, as well as other sources, report a very high cash position of several billion. But in a June 2021 article by Matt Briers the CFO, the following statement can be found:

We’ve got over £4 billion of cash-type balances. Importantly this includes £3.7 billion of Wise Account customer deposits, which we keep safeguarded and readily available. But this also includes £286.1 million of our “own cash”, and this cash balance is increasing thanks to the cash-generating qualities of the business we’ve built.

Even in the most recent reports, there is not much to be found on this, but rather very complex nested statements. I find this lack of transparency very dubious. This leads to the fact that the otherwise very reliable sources do not work here and the investor has to laboriously gather this important info. So, if I roughly estimate the numbers, it gives me an EV/S of about 20 (TTM). The PEG (Price/Earnings to Growth) ratio is about 200/40=5. I think the PEG ratio should be at a maximum of 2.

This valuation is too high for me to enter at the moment. I will put the share on my watchlist. It is currently in a clear downward trend and possibly a good entry point will come one day. In general, I like the business model and I think it still has a lot of potential.

However, there are of course also risks

In its latest annual report, the company lists a whole range of risks. So anyone who wants to read up on this in more detail should take a look at it. Some of the risks are:

- New competition with better products

- Macro-economic: Slowing worldwide economics

- Expansion risk: Potential problems with new regulations

- Credit Risk: Counterparties where Wise holds deposits

Overall, of course, other companies offer similar services. One example is the non-listed Revolut, which I also use.

Conclusion

Wise is a very interesting company with well-known investors. I know the product very well as I am a user myself. However, given the lack of clarity in the enterprise value, the high valuation, and the competitive market, I am waiting to see how the stock and the business will develop in the future.

Credit: Source link