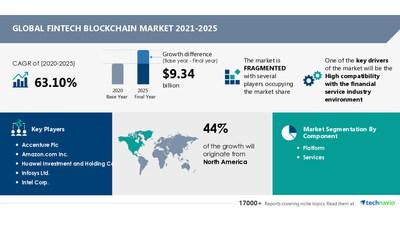

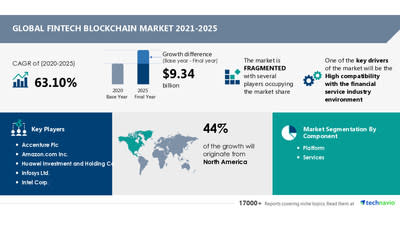

NEW YORK, Dec. 27, 2021 /PRNewswire/ — According to the research report “Fintech Blockchain Market by Component and Geography – Forecast and Analysis 2021-2025”, the market will witness a YOY growth of 62.00% in 2021 at a CAGR of 63.10% during the forecast period. Furthermore, this report extensively covers market segmentation by component (platform and services) and geography (North America, Europe, APAC, South America, and MEA).

For more insights on YOY and CAGR, Read our FREE Sample Report

Vendor Insights

The fintech blockchain market is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market. The vendors are deploying successful business strategies to frow their fintech blockchain market. To make the best of the opportunity, the market vendors should focus more on the fast-growing segment’s growth prospect while maintaining their positions in the slow-growing segments.

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

-

Accenture Plc

-

Amazon.com Inc.

-

Huawei Investment and Holding Co. Ltd.

-

Infosys Ltd.

-

Intel Corp.

-

International Business Machines Corp.

-

Microsoft Corp.

-

Oracle Corp.

-

SAP SE

-

Tata Consultancy Services Ltd.

Find additional highlights on the growth strategies adopted by vendors and their product offerings, Read Free Sample Report.

Geographical Market Analysis

North America will provide maximum growth opportunities in fintech blockchain market during the forecast period. According to our research report, the region will contribute 44% of the global market growth and is expected to dominate the market through 2025.

The US and Canada are the key markets for fintech blockchain in North America. The US dominates the fintech blockchain market and is a major revenue contributor because it has adopted advanced technologies early and offers ever-expanding startups. All these factors have made the US one of the leading countries in the regional market. Faster transactions will facilitate the fintech blockchain market growth in North America over the forecast period.

Furthermore, countries such as the US, UK, China, and Germany are expected to emerge as prominent markets for the fintech blockchain market during the forecast period.

Know more about this market’s geographical distribution along with the detailed analysis of the top regions. https://www.technavio.com/report/fintech-blockchain-market-industry-analysis

Key Segment Analysis

The fintech blockchain market is segmented on the basis of two Components – Platform and Services. As per the latest research reports, the fintech blockchain market share growth by the platform segment has been significant. The adoption of blockchain technology has offered decentralized and secured solutions that optimize business processes remotely. The fintech blockchain platform offers a distributed ledger in which every connected block holds batches of individual transactions and contains a timestamp linked to the previous block. This service helps eliminate some of the frauds that are taking place online against financial institutions.

View FREE Sample: to know additional highlights and key points on various market segments and their impact in coming years.

Key Market Drivers & Trends:

The high compatibility with the environment of the financial services industry is notably driving the fintech blockchain market growth. Fintech market spending is directly correlated with blockchain technology spending as Blockchain-based payments enable businesses to grow sales without the risk of fraud, the expense of legacy pay methods, or currency exchange complexity. In addition to the Fintech investment, blockchain technology also attracts investments from venture capitalists like UNICEF.

Fintech blockchains are also being used for payments, smart contracts, and digital identities. It allows us to transfer funds from one country to another within hours, Reduces the intermediaries in the payment process, and ensures the safety of our payment and information. All the above-mentioned factors will contribute to expanding the market size of fintech blockchain in the forecasted period.

Download free sample for highlights on market Drivers & Challenges affecting the medical education market.

Customize Your Report

Don’t miss out on the opportunity to speak to our analyst and know more insights about this market report. Our analysts can also help you customize this report according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time.

We offer USD 1,000 worth of FREE customization at the time of purchase. Speak to our Analyst now!

Related Reports:

Blockchain Technology Market in BFSI Sector by Type and Geography – Forecast and Analysis 2021-2025

|

Fintech Blockchain Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 63.10% |

|

Market growth 2021-2025 |

$ 9.34 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

62.00 |

|

Regional analysis |

North America, Europe, APAC, South America, and MEA |

|

Performing market contribution |

North America at 44% |

|

Key consumer countries |

US, China, UK, Canada, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Companies profiled |

Accenture Plc, Amazon.com Inc., Huawei Investment and Holding Co. Ltd., Infosys Ltd., Intel Corp., International Business Machines Corp., Microsoft Corp., Oracle Corp., SAP SE, and Tata Consultancy Services Ltd. |

|

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

About Us:

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/fintech-blockchain-market-size-to-grow-by-usd-9-34-billion–market-research-insights-highlight-the-high-compatibility-with-the-environment-of-the-financial-services-industry-as-key-driver–technavio-301450751.html

SOURCE Technavio

Credit: Source link