What could go wrong?

Kicking off 2022 may feel like we’re stuck the third round of 2020, but things have actually changed quite a lot in Technology Land, even if the pandemic is still with us.

Crypto has become far more established in the intervening period, for example, with more investors, startups and fundraising to be found in the space. Another change from the pre-pandemic days is the value of software revenues.

That may sound a little esoteric, but given that much of the startup world builds and sells software, the value of those incomes is incredibly important. If the value of software revenue rises, the value of software startups rises as well. That lowers investing risk. In turn, the climate for investing in software startups — which is most of them, mind — warms as risk decreases.

I won’t bore you with the mechanics of changing startup risk in a market rife with rising revenue multiples. What matters for our purposes today is to note that software became more valuable since the onset of the pandemic, inducing investors to fight over startup deals and preempt private rounds more often than was previously the norm.

The result? Rising startup prices.

The fact that startups have become more expensive, measured by comparing their valuations to their revenues, is reasonable. However, the H2 2020 software valuation boom tapered last year as SaaS and cloud stocks closed 2021 down a fraction from where they started the year.

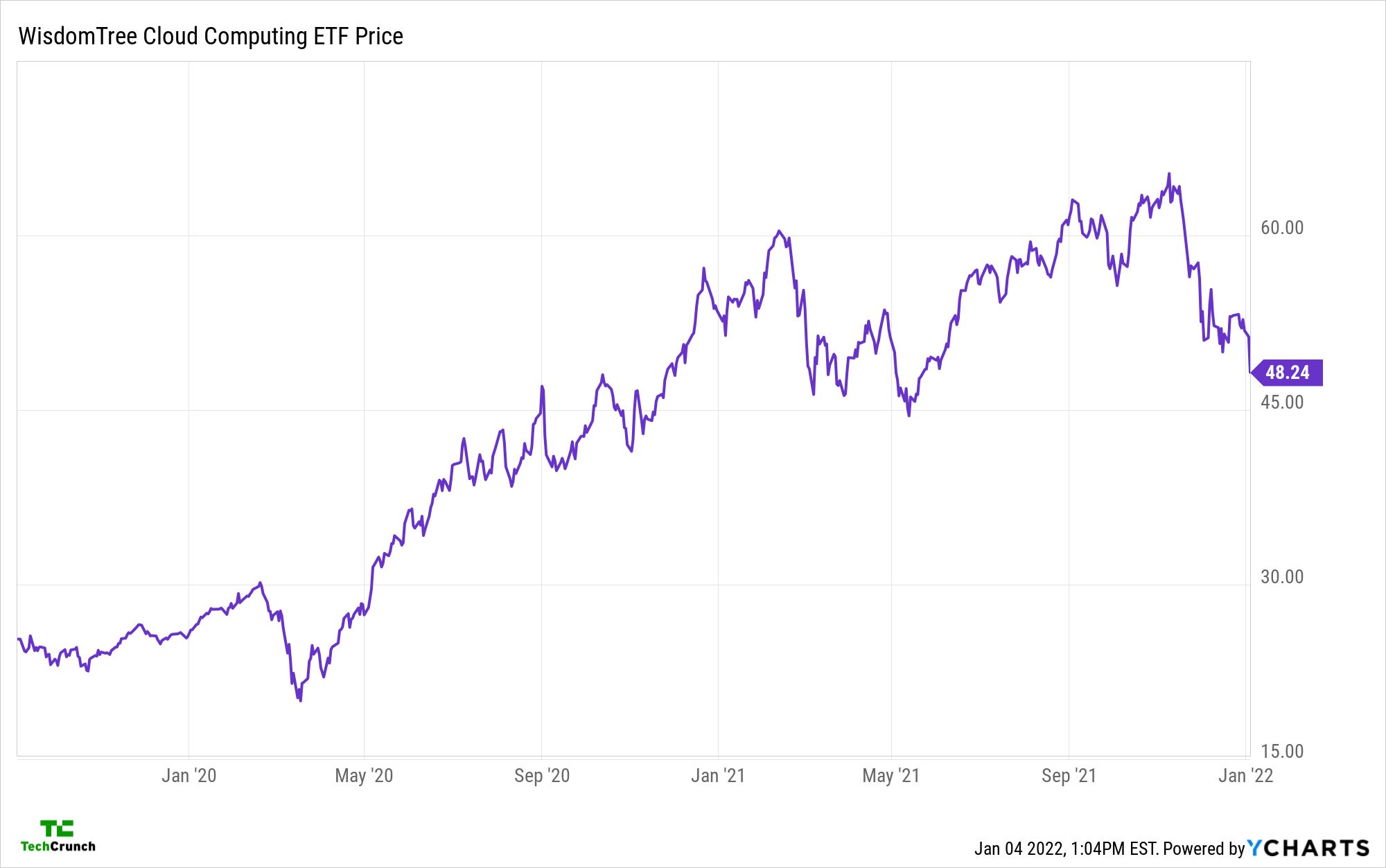

Even more, 2022 is starting off downright nasty for software stocks. The Bessemer Cloud Index (trackable as the $WCLD ETF), a basket of public software stocks, has lost ample ground thus far in 2022 (the following chart has a five-day range, so mind the dates):

Image Credits: YCharts

The index is off around 5.8% today as I write to you.

Zooming out, observe how the same basket of software and cloud stocks has lost ground since the start of 2021:

Image Credits: YCharts

Now normally this would not be an issue. Stocks go up and stocks go down. It’s what they are best at.

But there are second-order effects to consider. If the value of software stocks is on the ascent, startups benchmarking their present and future worth have rich comps to leverage. If those same software stocks lose ground, the startup comps start to make less sense. Thus the connection between public company prices and the value of startups.

As software stocks went up in 2020, tech investor willingness to pay more for less startup revenue rose. And it appeared to keep rising last year, even as software stocks struggled to hold onto their 2020 gains. But from a late 2021 peak, those same stocks have given back all their recent gains, and more.

Notably, this pretty sharp decline in value doesn’t appear to be hitting the private markets in the same way:

Credit: Source link