8vFanI/iStock via Getty Images

We’ve been covering certain Business Development companies, BDCs, in 2022, both small and large, in our recent articles.

BDCs offer retail investors high yield exposure to private companies, and some of them, like Triple Point Venture Group (NYSE:TPVG) focus on companies which are already backed by other venture capital firms. These other firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during the pandemic.

TPVG site

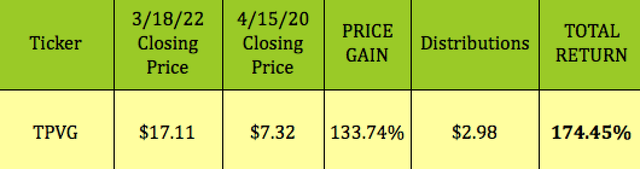

BDCs got slammed in the early 2020 COVID Crash, but, on the whole, they’ve been a good place to hang your hat over the past ~2 years. TPVG has delivered a 174% total return since bouncing back from the 2020 crash.

Of course, investors don’t get that kind of opportunity too often, with the market in panic mode, especially about the durability of the private firms that BDCs invest in. It took more than the usual grit to jump in or add to holdings during that dark time in 2020.

Hidden Dividend Stocks Plus

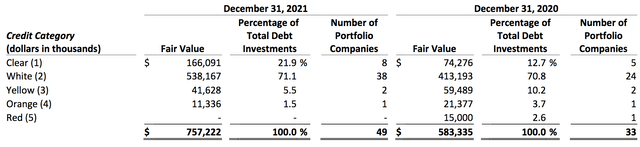

As it happens, most BDCs’ holdings weathered the lockdown storms. BDCs generally rate their holdings each quarter. TPVG uses a 1-5 tier system, with “clear” or 1 being the highest rating, and “red” or 5, being the lowest.

As of 12/31/22, there were no holdings in the lowest category, vs. 2.6% as of 12/31/20. The #4 and #3 categories also improved over 2021, with #4 dropping from 3.7% of the portfolio to 1.5%; and #3 dropping from 10.2% to 5.5%, as of 12/31/21.

The top #1 tier improved from 12.7% to 21.9% in 2021, while the #2 tier was stable, ending at 71.1%. TPVG had one portfolio company in which its investment was on non-accrual status (which was generally caused by events unrelated to the COVID-19 pandemic), with an aggregate cost and fair value of $29.5 million and $11.3 million, respectively.

TPVG site

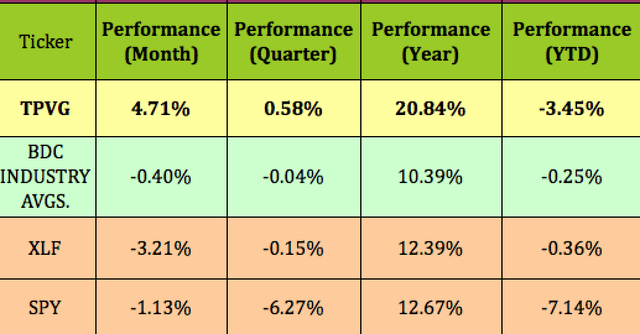

TPVG has outperformed the BDC industry, the broad Financial sector, and the S&P 500 over the past year, quarter, month, and so far in 2022:

Hidden Dividend Stocks Plus

Earnings

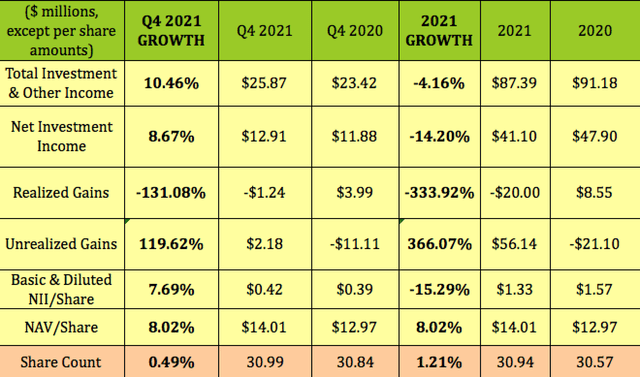

Q4 ’21 had solid growth in total and net investment income, rising 10.5% and 8.7% respectively, while NII/Share rose 7.7% and NAV/share rose 8% vs. Q4 ’20.

Full year 2021 wasn’t as impressive, with total investment income down a bit, -4%, and NII down -14%. However NAV/Share rose 8%, thanks to a major rise, 366%, in Unrealized Gains. The share count was relatively flat, up 1.2% in 2021.

Hidden Dividend Stocks Plus

New Business

In Q4 ’21, management signed a record $724.9M of term sheets with venture growth stage companies, and TPVG closed a record $232.3M of new debt commitments to venture growth stage companies. They funded $161.1M in debt investments to 19 portfolio companies, with a 14.4% weighted average annualized portfolio yield at origination.

As of 12/31/21, TPVG held debt investments in 49 portfolio companies, an increase of 22.5% from the prior quarter.

2021 was a record-breaking year in the venture market, with a total venture deal value of $330 billion, almost double that in 2020.

TPVG’s management sees the venture market as “especially strong for growth-stage companies within the late-stage venture capital market segment in which we operate. So far this year, the momentum continues.

Venture capital deal investment activity, particularly among our select group of leading investors has continued unabated here into early 2022. Second, there are several trends that we’re seeing in today’s market, which is driving incremental demand for TPVG. The longer time lines for SPAC and IPO transactions are prompting some companies to evaluate debt solutions. This increased timing to exit creates and fuels opportunities for our debt financing.

In other cases, many companies have completed equity rounds last year are either now seeking debt or seeking to upsize their debt with us or returning to TPVG for additional debt capital as a way to complement and enhance their equity raises in light of their future financing strategy.

TPVG portfolio companies raised a staggering $5.8 billion of fresh equity capital last year. Another promising factor is that many of these portfolio companies actually stand to benefit in this inflationary environment, along with the labor shortages in the supply chain backups.” (Q4 ’21 call)

Holdings

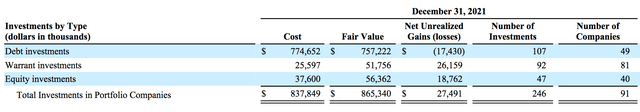

As of 12/31/21, TPVG had 246 investments in 91 companies, including 107 debt investments, 92 warrant investments, and 47 direct equity and related investments. The aggregate cost and fair value of these investments were $837.8 million and $865.3 million, respectively. As of December 31, 2021, 10 of its portfolio companies were publicly traded.

TPVG 10K

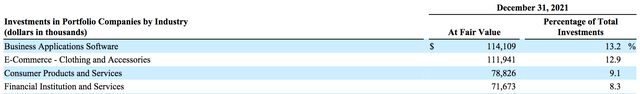

The holdings’ top 4 industries remained Business Applications, E-commerce, Consumer Products & Services, and Financial Institutions & Services, comprising 43.5% of its portfolio, as of 12/31/21:

TPVG 10K

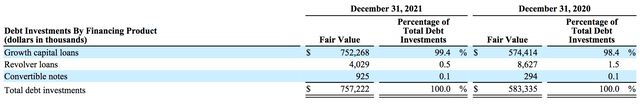

Debt investments were mainly in growth capital loans, 99.4% in 2021 vs. 98.4% in 2020, rising to $757M vs. $583M in 2020:

TPVG site

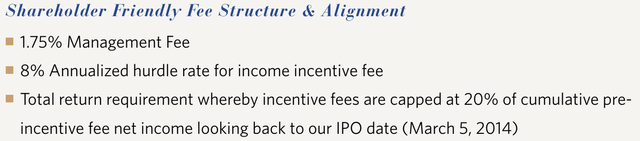

TPVG is an externally managed BDC. However, unlike some BDCs, the income incentive fees do have a hurdle rate and a cumulative cap lookback feature.

TPVG site

Distributions

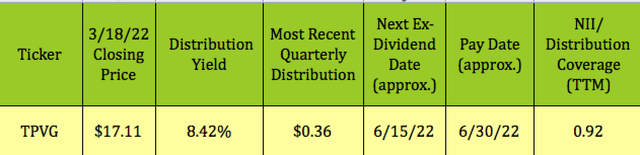

At its 3/18/22 closing price of $17.11, TPVG yielded 8.42%. Management has held the quarterly payouts at $.36 since Q4 ’14, with occasional special distributions of $.10 in Q4 ’18 and Q4 ’20.

Hidden Dividend Stocks Plus

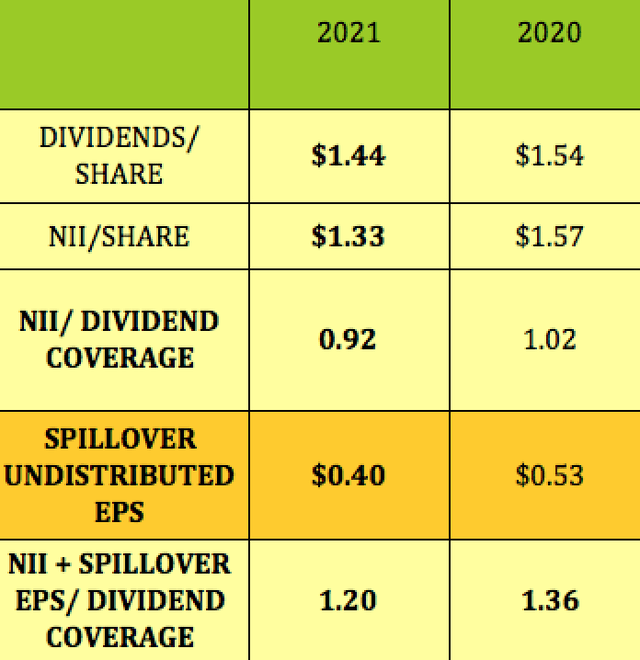

Distributions were slightly lower in 2021, due to a $.10 special paid in Q4 ’20.

NII/Distribution coverage was lower in 2021, running at .92X, vs. 1.02X in 2020. However, TPVG typically has undistributed, “spillover” EPS which gives it a positive coverage factor. It was 1.2X in 2021 vs. 1.36X in 2020.

Hidden Dividend Stocks Plus

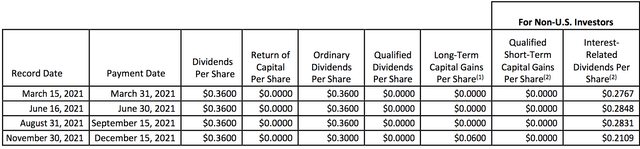

Taxes

2021 distributions were mainly ordinary dividends, with no Return of Capital, and just $.06 in long term capital gains/share.

TPVG site

Valuations

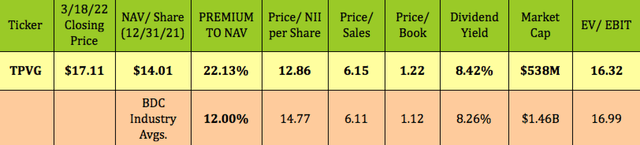

At $17.11, TPVG is selling at a 22% premium to NAV, higher than the BDC industry average of 12%. However, its Price/NII of 12.86 is lower than the 14.77X industry average, as is its EV/EBIT, while its 8.42% yield is slightly higher than average.

Hidden Dividend Stocks Plus

Profitability & Leverage

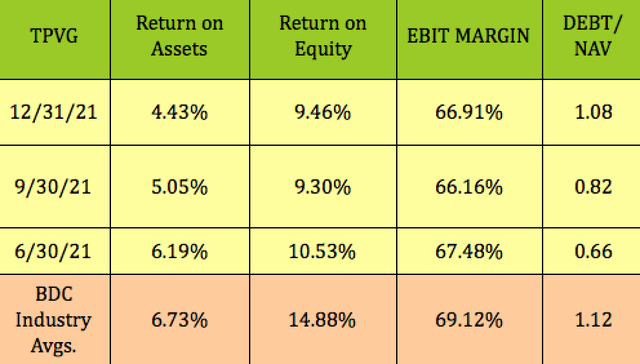

ROA has declined in the past 2 quarters, while ROA increased slightly vs. Q3 ’21, and EBIT Margin has been roughly stable. All 3 metrics are lower than BDC averages. Management increased Debt/NAV leverage in 2021, something we’ve seen a lot of in the BDC industry during the past year, as business conditions improved.

Hidden Dividend Stocks Plus

Debt

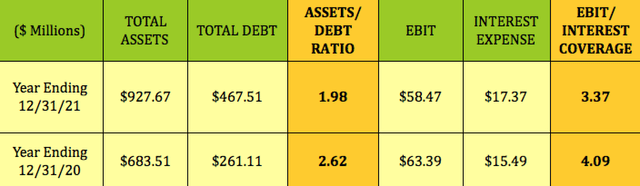

Management increased the asset base by ~36% in 2021, with debt rising by 79%, in order to improve earnings. Hence the Assets/Debt ratio fell from 2.62x to 1.98X, while EBIT/Interest coverage fell from 4.09X to 3.37X.

Hidden Dividend Stocks Plus

TPVG’s $350M credit facility’s revolver feature matures in November 2022, but also has an additional 18-month amortization period, if management doesn’t renew it. There are also $270M in Notes, which expire in 2025 to 2026.

It had outstanding borrowings of $200M and $51.27M in cash as of 12/31/22.

In late February 2022, TPVG announced the closing of a private notes offering totaling $125.0 million in aggregate principal amount of 5.00% Notes due February 2027. The Company intends to use the net proceeds from this offering to repay outstanding borrowings under its $350.0 million revolving credit facility, to fund investments in accordance with its investment objectives and for other general corporate purposes.

Parting Thoughts

Judging by the Q4 ’21 results and management’s comments, TPVG appears poised to continue its earnings momentum in 2022. While a 22% premium to NAV looks a little spendy vs. BDC industry averages, you may well see a pullback opportunity to buy TPVG a bit cheaper in 2022, given the geopolitical uncertainty, and the market volatility also caused by the new rising rate environment.

All tables by Hidden Dividend Stocks Plus, unless otherwise noted.

Credit: Source link